How to Pick the Right Travel Credit Card: A Guide for Travelers

Traveling the world for the past 10 years has taught me many things—how to find hidden gems, navigate different cultures, and most importantly, how to travel affordably. One of the secrets to my extensive travel experience is choosing the right travel credit cards. By leveraging points and miles, I’ve managed to travel to 75 countries without breaking the bank. In this post, I’ll guide you through the process of picking the right travel credit card to suit your needs, whether you’re an international adventurer, a domestic explorer, or someone who just wants to maximize rewards.

Why Travel Credit Cards Matter

Before diving into the details, let’s talk about why travel credit cards are so valuable. When used responsibly, these cards can be a gateway to free flights, hotel stays, and even upgrades to premium cabins. They offer rewards for everyday spending, and with the right strategy, you can accumulate points and miles that translate into significant savings on your travel expenses.

Over the years, I’ve learned that the key to maximizing these benefits is choosing a card that aligns with your travel habits. Whether you’re flying internationally, staying within the country, or focusing on earning rewards through dining and shopping, there’s a card out there that’s perfect for you.

Step 1: Identify Your Travel Goals

The first step in choosing the right travel credit card is identifying your travel goals. Ask yourself these questions:

- Do you travel more internationally or domestically?

- Is there a specific airline or hotel chain you prefer?

- Do you spend more on dining out, shopping, or other categories?

- Are you looking for a card with a strong introductory offer?

Your answers will guide you toward a card that offers the best rewards for your lifestyle.

Step 2: Consider Your Home Airport

If you frequently fly out of a particular airport, it’s worth considering a card associated with an airline that has a hub there. For example, if you live near Miami International Airport, American Airlines might be a good choice since it has a major hub there. By choosing a co-branded card, you can earn extra miles on that airline, receive priority boarding, free checked bags, and other perks that enhance your travel experience.

Step 3: Analyze Your Spending Habits

Next, take a close look at where you spend the most money. Travel credit cards typically offer bonus points in certain categories:

- Dining Out: If you’re someone who enjoys eating out, look for a card that offers extra points or miles for restaurant spending.

- Groceries and Shopping: Some cards reward you for everyday purchases like groceries and shopping, allowing you to accumulate points faster.

- Travel Purchases: Cards that offer high rewards for travel-related purchases such as flights, hotels, and car rentals are ideal if you’re booking travel frequently.

For instance, a card that offers 3x points on dining and 2x on travel can be a powerhouse if those are your primary spending categories.

Step 4: Evaluate Introductory Offers

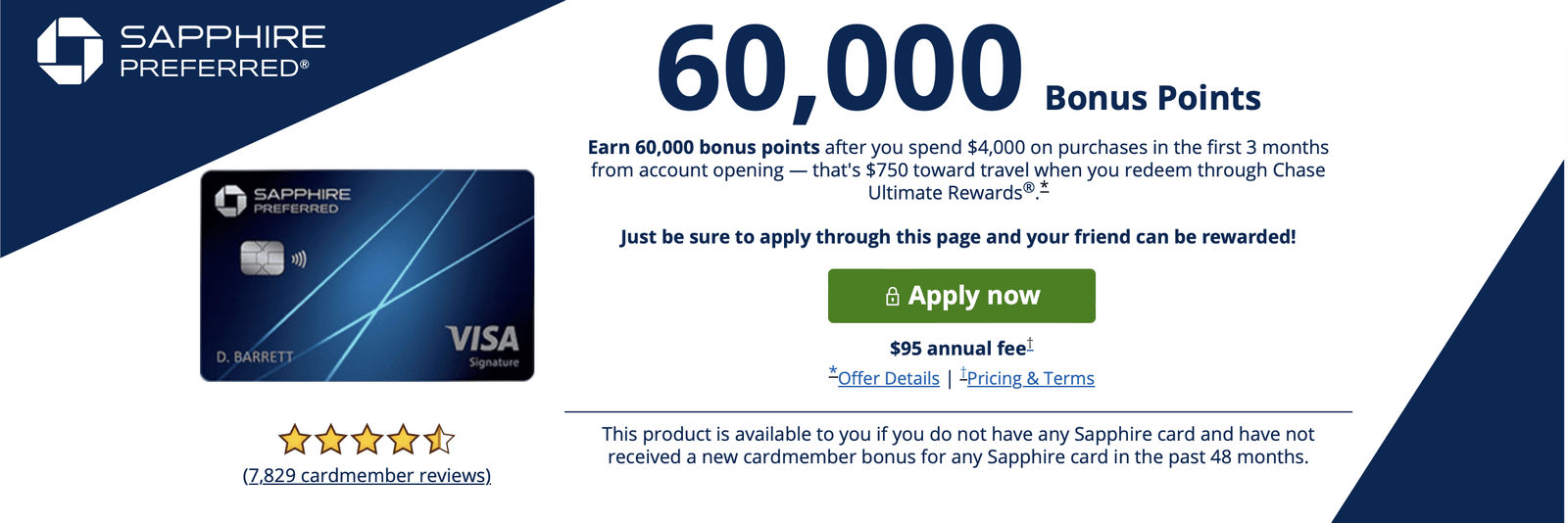

One of the best ways to rack up a significant amount of points or miles quickly is by taking advantage of introductory offers. Many travel credit cards offer large sign-up bonuses when you spend a certain amount within the first few months. These bonuses can often be enough to cover a round-trip flight or several nights at a hotel.

However, it’s crucial to ensure that the spending requirement aligns with your budget. You don’t want to overspend just to meet the threshold. Instead, plan your spending carefully—perhaps timing the sign-up with a major purchase you were already planning.

Step 5: Assess the Annual Fee and Benefits

Many travel credit cards come with an annual fee, which can range from $95 to over $500. While a high annual fee might seem daunting, it can be worth it if the card offers significant perks such as:

- Free checked bags

- Priority boarding

- Airport lounge access

- Annual travel credits

- Bonus points on anniversaries

For example, if you’re a frequent traveler, the value of lounge access alone can outweigh the annual fee.

Step 6: International Travel Considerations

If you’re like me and travel internationally often, you’ll want a card that has no foreign transaction fees. These fees, which can be around 3% per transaction, add up quickly when you’re abroad. Additionally, some cards offer benefits like travel insurance, trip delay coverage, and rental car insurance, which can provide peace of mind when you’re far from home.

Step 7: Consider Flexibility and Transfer Partners

Finally, consider whether the points or miles you earn can be transferred to airline or hotel partners. Flexible points programs, like those from American Express Membership Rewards, Chase Ultimate Rewards, or Citi ThankYou Points, allow you to transfer points to multiple airline or hotel partners. This flexibility can be incredibly valuable when trying to book award travel, as it gives you more options and potentially better redemption rates.

My Top Travel Credit Card Picks

- Chase Sapphire Preferred: Great for international travel, offering strong travel rewards and flexibility with transfer partners.

- American Airlines AAdvantage Card: Ideal for those loyal to American Airlines, with perks like free checked bags and priority boarding.

- American Express Gold Card: Perfect for dining and groceries, offering 4x points on these categories.

- Capital One Venture Card: Often has a great sign-up bonus and offers 2x miles on every purchase.

Final Thoughts

Choosing the right travel credit card is a game-changer when it comes to affordable travel. By aligning your card with your travel habits and spending patterns, you can maximize rewards and enjoy perks that make your journeys even more enjoyable. Whether you’re looking to earn free flights, hotel stays, or simply want to enhance your travel experience with extra perks, the right card is out there waiting for you.

Remember, responsible credit card usage is key. Always pay off your balance in full each month to avoid interest charges, and don’t let the allure of points and miles lead you to overspend. With a thoughtful approach, you can unlock incredible travel opportunities and join the ranks of those who explore the world without breaking the bank.

Happy travels!

Be sure to check out my YouTube channel and explore more of my travel adventures for tips and inspiration to make the most of your journey!

Recent Posts

My Haiti Trip: Culture, History & Caribbean Soul

A World on a Plate: Discovering Global Flavors in Abu Dhabi 🌍🍽️

Viral Villas Around the World

Aruba Travel Guide: Best Hotels, Things to Do & Where to Eat

Subscribe To Newsletter

Subscribe to newsletter to receive latest news and updates!